Property, is it really all doom & gloom?

Is it really all doom and gloom?

With all the doom and gloom being reported in the press using increasingly emotive language which is aimed firmly at seeking to increase their share of the readership it is difficult for landlords to manage anxiety levels.

Interest rates

Let’s first look at some facts. Yes, The Bank of England (BoE) have increased base rate to 3% which is the eighth consecutive increase since December last year. But prior to the most recent rate rise and post the mess created by the not so mini budget, an emergency hike of 1.5% had been expected. Furthermore, the market had adjusted its expectation of rates to peak at potentially near to 6%. The reality is we have only seen half this.

So, why are fixed rates at 5-6% or more when the BoE rate is only 3%? The reason is the fixed income markets that trade overnight swap rates (the rate lenders pay to hedge their risk for future fixed rate mortgages) as we have said, believed the BoE rate to peak at 5.75%. In short this meant an awful lot of future rate hikes have already been priced into the rates we are experiencing today. Let’s also not forget this was in September when we had Liz Truss and Kwasi Kwarteng in number 10 and 11 Downing St!

Andrew Bailey, the governor of the BoE has since issued a warning that this expectation was too high, and that rates would go up by “less than currently priced in financial markets”. Rates are typically priced off the market curve – where investors think Bank Rate will be in the future – and so when that curve jumped after the mini-Budget, mortgage rates inevitably increased.

“I would hope that is now calming,” Bailey said, as the curve is falling, and becoming more predictable.

Mortgage rates

The result is, mortgage rates (variable rates excluded) are unlikely to increase much more if at all. Indeed, we have recently seen some lenders reduce their rates. We also know that the BoE are not prepared to totally crash the economy for the sake of inflation, which is a whole other conversation. Bailey said that increasing rates to the 5.25% level recently expected by markets would trigger a two-year recession and cut household real incomes by £800 in 2023. He said this should serve “as a reminder that we should not increase Bank Rate too far”.

But there has been a spike in borrowing costs and this alongside continued high inflation and a rising cost-of-living have prompted predictions from the most bearish forecasters of 20%-30% falls in UK house prices, but such assumptions are not based on any evidential research and are really nothing more than clickbait.

House price projections

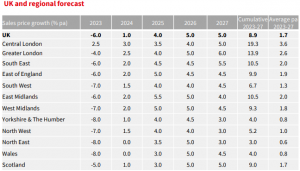

Looking at some of the expert projections these tend to be far less depressing. For example, JLL expects a sluggish market to emerge in which buyers and vendors haggle over price, and ultimately less transactional activity occurs with the supply of new homes for sale gradually becoming constrained. Against this backdrop, they are forecasting that UK house prices will fall in value in 2023 by 6%, which equates to an average discount of £17,500 from the average UK house price of circa £290,000.

In 2024 they expect price growth to recover slightly and go back into positive territory at 1.0%. The cumulative figure between 2023 and 2027 is expected to be +8.9%

On the assumption that interest rates gradually ease back from the middle of 2024 it is expected that values will gradually begin to recover, Savills are projecting a net figure of+6% in nominal terms over the next five years. At the same time, they project there to be a fall in housing transactions to levels a little less than three quarters of the pre-pandemic norm. By end of the forecast period (2027), the average UK house price is expected to be at £381,578, a £22,290 gain over five years. This will put prices a significant £92,000 above the pre-pandemic level, following two and a half years of considerable growth (+24% to the end of September).

Looking at Scotland Savills forecast a drop in value of -9% next year then a rise of +20.3% between 2024 and 2027 so the net five year forecast is +9.5%. JLL forecast a cumulative growth for the period 2023-27 of +9% this equates to an average of +1.7% PA between 2023 and 2027. This is hardly a crash, especially considering how other asset classes have been performing.

Source JLL

Urban areas performing well

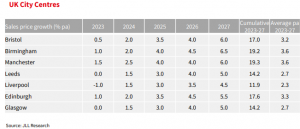

Interestingly after all the chat post pandemic about the of the death of the office and rise in home working, the outlook for the UK’s city centres is strong. In fact house prices are still expected to grow in the centre of many of the UK’s largest cities albeit at much reduced rates. Focusing on Scotland JLL do not expect prices to drop into negative territory in Glasgow or Edinburgh.

Source JLL

Focus on rental market

Let’s now focus on the rental market. The rental market continues to be resilient in the face of growing pressures from inflation, interest rate rises and the resultant squeeze on the cost of living.

As interest rates increase so too will demand for rental stock since many people will not qualify for a mortgage on a primary residence. Lending standards for mortgage loans become much tighter when interest rates rise. Mortgage lenders who previously qualified house hunters at a lower rate will need to recalculate. Often, the number crunching leaves a lower number of qualified home buyers. Around 7 out of 10 prospective first-time buyers’ (FTB) attempts to purchase a property have been impacted by the rising cost of living. A recent survey by the Aldemore Bank found that 32% of prospective FTBs have put their property purchases on hold, anticipating delays of 20 months on average and hence these people remain in the PRS.

There is clear evidence that people are staying put and remaining within the Private Rented Sector in some recent research by Savills it was found that commitment to move among prospective buyers has fallen.

Increasing tenant demand

In the most recent Propertymark Private Rented Sector Report 73% of all agents surveyed report they have seen an increase in the number of tenants renewing their tenancies over the past 12 months. At the same time demand levels are increasing with Propertymark reporting 127 new applicants registering per branch in July, a number which has been increasing slowly since July while the number of available properties has remained stable at 11 since June.

The Royal Institute of Chartered Surveyors (RICS) also report that tenant demand continues to rise, evidenced by a net balance of +50% of respondents reporting an increase in tenant demand over August. Alongside this, the latest net balance for landlord instructions came in at -13%, with falling supply across the rental market an ongoing theme over much of the past five years.

The increasing demand levels we see is coming at time when stock levels appear to be falling. Zoopla report that the stock of homes for rent remains almost half the average compared to the last 5 years. The average letting agent has just 8 homes available to rent – half that of the summers 2017-2019. The flow of new homes to rent is running 7% below the long-term average, as renters stay put to avoid rent increases.

The result is the market is experiencing a significant supply demand imbalance that is driving rental inflation. All the portals are reporting rising rents, Rightmoves Director of Property Science Tim Bannister said:

“The story of the rental market continues to be one of high tenant demand but not enough available homes to meet that demand. Last year we saw exceptional numbers of tenants looking to move and this year we have seen no let-up in this trend. Whilst stock levels are beginning to improve, with June seeing the highest number of new rental listings coming to market so far this year, the wide gap that has been created between supply and demand over the last two years will take time to narrow.”

Energy efficient new build city centre homes are expected to prove popular with renters looking at ways to minimise their energy bills. This will boost demand for new urban rental homes underpinning stronger rental value growth.

We expect tenant demand levels will remain high and may well increase so competition for rental stock will be intense and average time to let (TTL) numbers will likely remain at historically low levels.

Market resilience

The result of all of the above is the rental market continues to be resilient in the face of growing pressures from inflation, interest rate rises and the resultant squeeze on the cost of living. The private rented sector (PRS) tends to be counter cyclical to the sales market since it is more resilient with activity falling less severely and rebounding more quickly after financial and economic shock than seen in the sales sector. In times of uncertainty people still need somewhere to live but often prefer to rent rather than buy homes due to the inherent flexibility renting gives people. This means rental demand can actually increase during a recession. At the same time actual supply of stock does not tend to increase which has the effect of keeping rental inflation in positive figures. It can in fact act a bit like a safety valve when the purchase market goes into reverse.

Investing

The result of all of this is investors and landlords need to try and filter out all the noise and focus on the long term. This, of course, doesn’t mean sticking one’s head in the sand and not paying attention to the market. But it does mean not panicking and over reacting, rather it is time to take stock, look at all the variables, remove the emotion and make properly informed decisions.

Investing in property is a long-term play. The goal of any investor should be to focus on this and not worry about the short term. When an individual is prepared from the outset for episodes of volatility on their investing journey, they are less likely to be surprised when these happen.

At Glenham we are landlords ourselves and understand the concerns of our clients. As a professional asset management company, we are focused on ensuring our clients benefit from the best possible returns from their investments.

If anyone would like to have an informal chat about the market and their properties, and mitigating risk please do get in touch here.

Related Posts

Navigating Opportunity, rental market update

11 August 2025