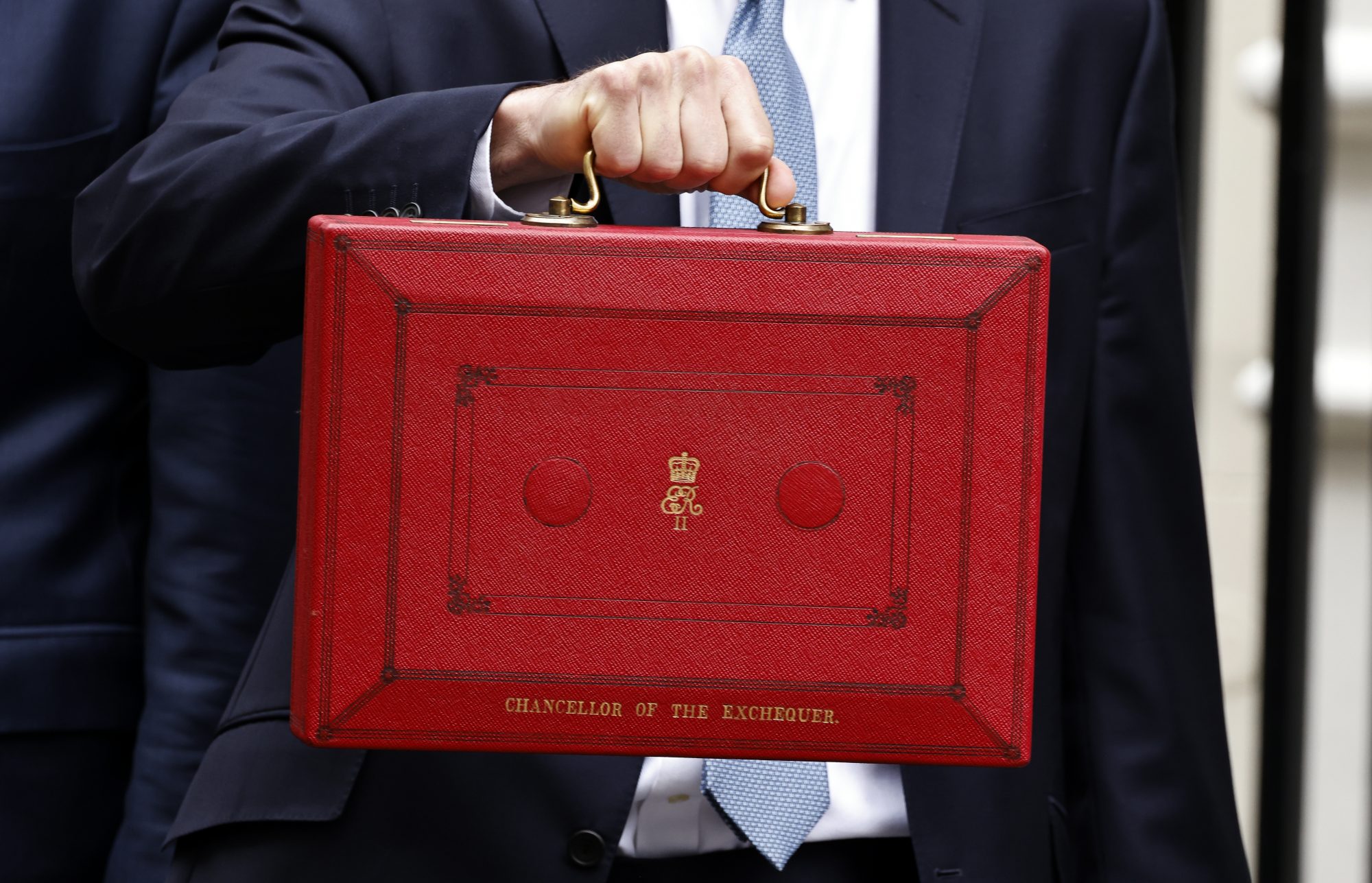

Budget

Labour have delivered a budget that represents a radical shift in fiscal policy with the key headline of £70 bn in additional spending that will reshape the UK’s economic landscape. This extra spending will be paid for by a roughly £40bn a year increase in taxes and a £32bn a year increase in borrowing. The majority of the extra tax revenue (£25bn) will come from raising employers’ national insurance contributions (NICs) with most of the rest made up by changes to capital gains, inheritance tax and ‘efficiency savings’.

In the weeks leading up to the big day there were all sorts of forecasts flying around which had the effect of spooking the market but the actual outcome has been more benign for property investors than many had anticipated.

While Capital Gains Tax (CGT) rates on profits from shares and certain other assets has increased from 10% to 18% for lower-rate taxpayers and from 20% to 24% for higher-rate taxpayers, it is at least somewhat reassuring for property investors to note that the rates for residential property gains remain unchanged at 18% and 24%.

Economic impact

But we need to consider the fallout on the wider economy and the effects are likely to be both immediate and far-reaching. We believe there are four primary implications for economic growth, inflation, and interest rates:

1. Short-Term Boost to Growth: In the near term, the fiscal expansion, which includes increased government spending, is expected to boost economic growth. The OBR forecasts a temporary uplift, with GDP growth potentially increasing by approximately 0.6% in 2025-26. However, this boost is expected to taper off over the subsequent years as increases in employers’ national insurance contributions reduces longer term growth by about 0.1% as fewer people are employed.

2. Shift in Growth Composition: Though the increase in tax and spending is roughly neutral in terms of overall growth, we anticipate a shift in the composition of that growth. With higher NICs, businesses may face increased wage pressures, potentially resulting in moderated consumer spending. Additionally, government spending may “crowd out” private sector investment, meaning that as public investment rises, private business investment may contract, balancing the net impact on growth.

3. Rising inflation: The combination of heightened government spending and increased labour costs is expected to elevate inflation. Having fallen back to around the 2% target in mid-2024, the OBR expects CPI inflation to pick up to 2.6% in 2025, partly due to the direct and indirect impact of Budget measures. Inflation then hopefully slowly returns to the 2% target by the forecast horizon.

4. Inflationary Pressures and Interest Rates: Upward pressure on inflation is likely to impact interest rates. Consequently, rate cuts may occur more gradually. The OBR estimates the policy measures will raise interest rates by about 25bps. That means interest rates will probably now only be cut quarterly, leaving them at around 3.75% by the end of next year.

Office of Budget Responsibility forecasts

David Miles, the chief economic adviser to The Office for Budget Responsibility (OBR) said:

“The [fall in disposable incomes] is inevitable when the government is taking 2% of national income to spend on public services and public investment.”

It is notoriously difficult to predict when we might see more significant drops in mortgage rates, since their movement is dependent on many differing variable factors these include what happens with inflation, falling swap rates, legislation and unexpected shocks to the economy.

The impact of the budget looks like mortgage rates are likely to fall more slowly than had been anticipated just a few days ago. The OBR has forecasted that interest rates will fall to 3.5% by 2029, but this is around 0.5% higher than it had forecast in March and 0.25% higher than it predicted before seeing the Budget measures. This will lead to mortgage rates staying higher for longer with 1.8 million homeowners on fixed rate deals set to expire in the next year. The Budget has also sparked some volatility on the financial markets with traders pushing the government’s borrowing costs higher because they expect UK debt to rise.

Interest rates

The result is Lenders are mulling what action the Bank of England (BOE) might take on interest rates and the mortgage market remains volatile. The Bank meets next week and again on the 20th December to determine the level of the Bank Rate, which currently stands at 5%. Markets are still pricing-in a 0.25% rate cut from the Bank next week but they no longer expect a further cut before Christmas.

We also do not expect a return to the ultra-low rates we saw between 2009 and 2021 unless there is some significant economic shock. Economists expect rates to settle at around levels seen pre the financial crash. Economists call this the equilibrium or neutral interest rate which is expected to be circa 3.5%. A neutral bank rate of about 3.5% would mean mortgages of about 4.5% to 5% and investors should factor this into their stress testing when looking at potential investments.

Impact of property market

So, what impact can we expect this to have on the property market?

At this point it is important to point out that the stamp duty surcharge in England will rise by 2% which may result in reduced investment into the PRS south of the border. But the increase will have little effect in Scotland where the Additional Dwelling Supplement was increased in December 2022 to 6%.

What the effect of the increase in the surcharge south of the border may have on the overall market remains will be interesting to see. But there has already been some fallout as Estate Agents are bracing themselves for a potential surge in property fall throughs in the coming days, as well as renegotiations on already agreed deals, following the hike in the stamp duty rates.

The Office for Budget Responsibility (OBR) released its latest predictions this week for both house prices and future mortgage rates moving forward and it showed an uptick compared to its March predictions.

The OBR’s central forecast is that house price growth will fall back marginally from 1.7% in 2024 to 1.1% in 2025, as the average effective mortgage rate continues to rise.

In a statement the OBR said: “House prices have risen by around 3% in the first half of the year, such that the average house price was around 3 per cent higher than our March forecast in mid-2024.

“Average house prices remain above our March forecast throughout, driven by the recent resilience and our forecast for higher nominal incomes.”

“This would leave the average house price in the UK at £310,000 in 2028, around 2.5% higher than our March forecast.”

If anticipated interest rate cuts do materialise, coupled with ongoing wage growth, buyer affordability constraints should ease and this should at least stimulate the market to a degree. So, we expect UK house price growth to remain subdued but stable in the medium term but the changes in the stamp duty surcharge south of the border will act as a drag on buyer sentiment. We anticipate the Scottish property market will continue to outperform the broader UK market, as the impact of the stamp duty surcharge will be minimal due to Scotland’s devolved approach to property taxation.

For investors in England who may be reconsidering their investment strategy, I encourage them to look at Scotland. Despite tax adjustments and regulatory changes impacting the buy-to-let sector north of the border the market fundamentals remain robust. The sector has a proven track record of successfully navigating the ever shifting regulatory and economic landscapes. This resilience showcases the Scottish market’s strength and adaptability, offering a reliable option amid the current changes south of the border.

Keep calm!

Overall, it is important that investors keep calm and don’t react to the current challenges with a knee jerk reaction. Over the past decade, buy-to-let (BTL) landlords have faced a range of regulatory, tax, and legislative reforms with each initially being viewed as a potential existential threat. Yet, time and again, the market has demonstrated remarkable resilience and adaptability this offers a compelling opportunity for investors to address the ongoing demand for rental housing while also benefiting from steady, reliable returns.

If anyone would like to have a chat about the market and opportunities therein please do get in touch.